1. Portfolio risk/Reward

2. High probability trade

3. Commission slippage

4. Quality vs Quantity

Do more with less

5. Avoid massive losses

This blog is a journal of charts on ASX stocks in various point in time. You might find charts on Major forex pairs,Nasdaq and SGX stocks as well.It reflects the author personal view. Its neither advisory or invitation to trade. All done in the interest and passion for the market, trading, technical analysis and elliot wave. And to exchange view, opinions with traders worldwide. .

Personal Favourite links

tweet

Friday, July 30, 2010

Thursday, July 29, 2010

Wednesday, July 28, 2010

Tuesday, July 27, 2010

Monday, July 26, 2010

UK:BP - Strike again.

I was planning to get into BP if it comes lower but by looking at todays opening price action, maybe not. Jump into the band wagon with a tight stop. Keeping in mind individual as well as portfolio risk/reward payout and ratio. Looking at exit target of 475 which is the natural objective by the resistance of the parallel trend channel and the meeting of the 2nd Movong average line. So good luck to myself.

Sunday, July 25, 2010

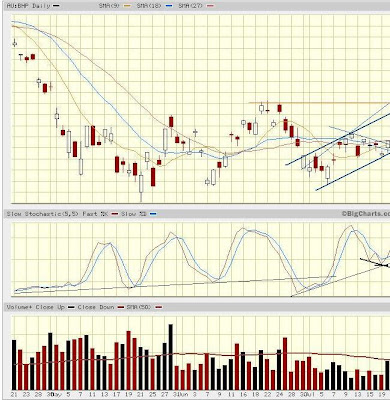

QBE : What hat happen to the bullish candlestick ????

Prices form by traders to get Bullish candlesticks quickly collapse to pressure of the downward trend channels, confirm also by prices below moving averages.

Saturday, July 24, 2010

Santos : Hindsight analysis.

What happened ??

Had taken a position in Santos at about $13.68 looking for a bullish 5th wave. with a stop at $13.50. Prices was strong thru midday but collapse at the end. Disappointed and disouraged at the weakness. Next morning seems to continue on with the weakness. Exited at B.E.P.

What could have happened and should happen ?

1. Could have sold out at $13.90s on the day itself and abit of next day. Dipped down, rebounded before crashing. Of course I would never have known that would happen. So better safe than sorry. B.E.P is better than a loss.

2. Could have a lower stop although that would mean change the position sizing and the risk/reward ratio. But it would not have been stopped out if the trade carried on.

3. Prices rebounded from support at about stop loss level....urgggh....

4. If I had a lower stop loss, stop would not have been triggered and position is intact for the upside.

5. Ideally thought what could have happen is , Exit at $13.90s and but back at $13.40s, that would have been wicked.

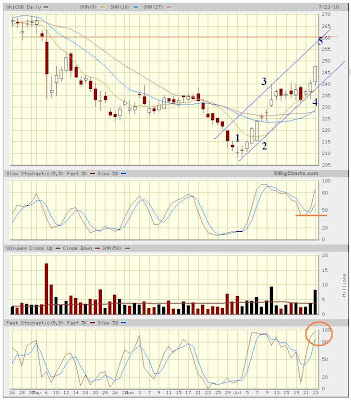

Santos : STO : 2nd chance ?

At first glance, looks like Buy. But the upside seems rather limited considering the

resistance line on the weekly chart. Parallel channel lines on the daily chart seems

to suggest at least $14.50 to $14.75 which is also where the resistance lines on the

weekly chart meets. If stop is at $0.20 and working at 1:3 or 1:4 risk/reward ratio

target is about 60cts or 80 cts which will work out to $14.50. Whether it will go

higher, will have to see.

resistance line on the weekly chart. Parallel channel lines on the daily chart seems

to suggest at least $14.50 to $14.75 which is also where the resistance lines on the

weekly chart meets. If stop is at $0.20 and working at 1:3 or 1:4 risk/reward ratio

target is about 60cts or 80 cts which will work out to $14.50. Whether it will go

higher, will have to see.

Thursday, July 22, 2010

COB was not in the original list but saw this after seeing DOW up close to 300 pts, cannot resist the temptation to jump into the bandwagon. Hopefully, there is still steam for further 5th wave upside. The analyst and talk show have been mentioning about the low volume in the past few days and weeks. Traders sidelined to see whether the bulls or bears wins this tug of confidence war. From what I am hearing is that there is cash in the market and investors are sidelined. Well that is a pre-requisite for a rally of some sorts.

UK : ISYS : Invensys

Invensys : ISYS : is one of my first foray into the UK market. Never in my trading history have I dabbled in UK stocks. Technology has make this all possible....anyway, this is not a very good trade for me. See the 2 dots on the chart, they represent my entry and exit levels. I barely scratch BEP while prices bounce off the minor correction. .........take a look at my previous post

http://lcmtradingportal.blogspot.com/2010/07/ukisys-invensys-plc.html

http://lcmtradingportal.blogspot.com/2010/07/ukisys-invensys-plc.html

UK : Rolls Royce

Took a Rolls Royce pot shot at this stock. Taken a chart picture on the Iphone. Saw a nice consolidation. A 4th wave. ........

Hourly chart

Hourly chart

.......Maybe exited abit too quickly but for a kill shot like this on the move....cannot argue with the profit....

UK :LLOYD : lloy

A Weekly Chart Perspective. Triangular consolidation. Break to the upside ??

......Took a position for an upward move. Although stop is abit too fine maybe ?? Just below the day's Opening price.

CUP & SAUCER : Further upside move imminent.

......Took a position for an upward move. Although stop is abit too fine maybe ?? Just below the day's Opening price.

CUP & SAUCER : Further upside move imminent.

Wednesday, July 21, 2010

WhiteHaven : WHC :

.One reason to load up on Whitehaven: coal shakeout Macarthur is problematic to take over -- more on that later -- but there's appeal in Whitehaven as it ramps up capacity from 4 million tonnes to 11.5mt by 2013.According to Burrell Stockbrokers' Peter Wright, it's not just the coal that is of interest; Whitehaven also has loading slots at the expanding Kooragang Island facility on the Hunter River. "As the only independent with landing slots at Kooragang Island you don't need CSI to work out what might happen," he says.

Tuesday, July 20, 2010

SuperCheap Auto : Tiangular Brewing .......

A closer look on the daily chart :

Seems like prices have some more triangular room to fill.....

Price restlessness still there.....

Specualtive play I guess....at the moment all speculators are sidelined ......

......A possible "A-B-C-D-E" price scenario

....another perspective...price rise to finish a "C". Price break out of the current mini 5th wave to complete a minor "c" which also completes the major corrective "Z" wave. Before collapsing .....

Subscribe to:

Comments (Atom)